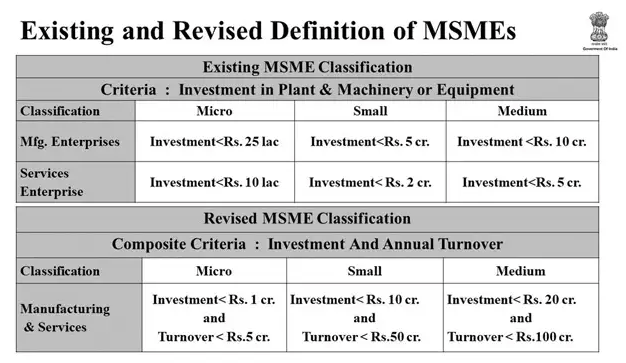

Since October 2019, the latest MSME definition was always news. In an effort to generate five crore jobs in the MSME industry , the government declared that the MSME concept will change, where turnover determines an MSME, rather than production.

The Center officially revised the MSME definition on 13 May, Wednesday.

The economic growth of a nation depends largely on the development of its manufacturing and service industries. Such markets now have many small companies in developed countries in the rising process. Given its role in economic growth , the government ensures that these industries receive all kinds of benefits and creates a conducive atmosphere for their production.

In India the SMIs are known as MSMEs (Micro , Small and Medium Enterprises). The Central and State governments, beginning with MSME registration to provide a number of incentives for better performance, do not leave any stone unturned to help SSIs flourish.

The new MSME definition – Turnover to define MSMEs

MSMEs are no longer going to be characterized by investment. Union Minister Nitin Gadkari said in October 2019 that the revised definition of micro, small and medium-sized businesses could provide a uniform description of everything relating to taxation, investment, and more.

The modified concept was to be introduced by an amendment to further improve the market scenario of Indian firms.

The Union Cabinet approved an amendment to change the requirements from “Investment in plant and machinery” to “annual turnover” of classifying MSMEs.

Finance Minister Nirmala Sitharaman added the additional turnover principle together with investment on 13 May 2020.

Definition of MSME – why Need a change

When Finance Minister Nirmala Sitharaman declared the change, she also spoke of the reasons for the move. She said that the current concept would offer several benefits that help MSMEs rise in size.

This was achieved under the Atma-nirbhar Bharat Abhiyaan Economic Package to mitigate the poverty pandemic in India. In combination with all previous efforts to stimulate the economy, the total relief package amounts to a huge Rs. 20 lakh crore.

Atma-nirbhar Bharat Abhiyaan – Key Announcements

- Rs 3 lakh crore collateral free automatic loans for MSMEs

- Rs 50,000 crore equity infusion through MSME Fund of Funds

- Rs 20 crore subordinate debt for MSMEs

- Compliance extension and date of completion of RERA real estate ventures.

- Immediate pending refunds issuance to all non-charitable trusts

- Extension for FY’19-20 to 30 November 2020 of the due date for ITR

What are MSMEs and their role in Indian Economy? An Introduction

MSMEs represent the micro, small and medium-sized companies, which are a part of India’s manufacturing and service sectors. These SSIs provide more than 120 million people with jobs and contribute more than the agricultural sector to GDP.

If we talk about the manufacturing sector, the contribution to GDP is about 6,11%, whereas it is 24,63% of the service sector. The MSMEs are rightly known as the Indian “Economic Growth Engine” with an export share of 45% and a growth rate of 10%.

Even in economic crises, the SSIs were strong and the reason behind the empowerment of the weaker economic sectors of society.

Since MSMEs are significant, the government has a multitude of advantages when it is registered under the MSMED Act. They are also referred to as MSME Registration Benefits. It is not compulsory to register small-scale industries, but this legal action is vital in order to make the most of these benefits.

But before we look at the benefits of MSME enrollment, let ‘s discuss how these are categorized.

Small-scale industry or MSMEs – classification

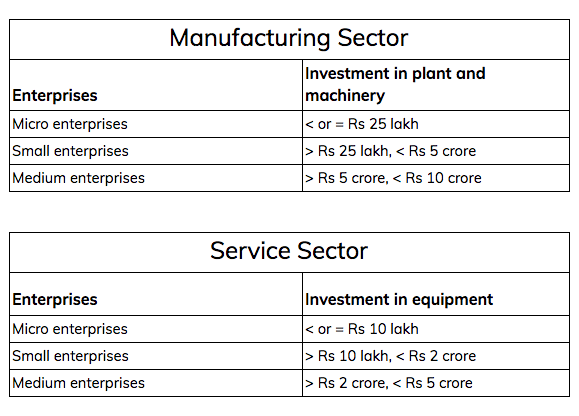

The SSIs was classified into two categories:

- Sector of manufacturing

- Field of services

The industrial industry manufactures finished goods using raw materials. The industries are described here as follows:

- Micro-Enterprise – Are the ones with an investment less than or equal to ₹25 lakhs in plant and machinery.

- Small Enterprise – Are the entities with an investment in plant and machinery of more than 25 lakhs but less than or equal to ₹5 crores.

- Medium Enterprise – The industries with more than ₹5 crores but less than or equal to ₹10 crores investment in plant and machinery.

In the service sector, intangible goods are made. In this business, the SSIs are:

- Micro Business – Companies that invest in machinery that does not surpass 10 lakhs of overall money.

- small businesses – those who invest more than 10 lakhs in equipment, but less than or equal to 2 crores.

- Medium Enterprise – an industry with investments in the equipment of more than ₹2 crores that do not exceed ₹5 crores.

In order to benefit from the benefits of MSME, micro, small and medium-sized companies must be licensed under the MSMED Act. Udyog Aadhar has been issued by the government to simplify the MSME registration process.

What is Aadhar Udyog?

Udyog Aadhar is a government program to encourage citizens to register their companies under the MSMED Act. In return, the companies are given an MSME Registration Certificate and a unique number that helps them to benefit from the MSME Registration Benefits.

The Udyog Aadhar MSME facility is here to simplify the certification process. In the past, MSME was a complex and time-consuming process involving a lot of paperwork. Now, things have become simpler with the Udyog Aadhar system. You just need to sign SSI online and reap the MSME login advantages like a BOSS!

[Udyog Aadhar is sure to help you to pursue your business in all respects. To learn more about Udyog Aadhar, please read our article What is Udyog Aadhar and why should you register? Read our article. ]

Benefits of MSME Registration

The State and Central governments ensure that the SSIs slowly expand and evolve and that their priorities are still taken into account. The businesses with MSME registration certificates can benefit from the benefits. Let us look at the advantages a small company can enjoy:

Economic assistance from government-approved banks

Financing for the financial needs of micro, small and medium-sized businesses can be quickly collected until it is registered under the MSMED Act. The Government helps to provide low interest rate subsidized loans from banks. It is one of India’s most important MSME registration benefits.

SSIs development schemes of the Central Government

In the case of schemes such as Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), the MSMEs are issued with collateral-free loans. In addition, through Pradhan Mantri MUDRA (Micro Units Development and Refinance Agency), Small Industries Development Bank of India (SIDBI), provides financial support to the MSMEs.

Tax benefits

Taking into account the type of business you do, you can exempt excise duties. In addition, you can also benefit from direct tax exemption benefits in your business’s initial growth phase.

Product reservation to be made by MSMEs only

The Government ensures that because the SSIs operate on a smaller scale, they do not die due to the prevalent pressure on the market. For this reason, certain products that only Micro, Small, or Medium Enterprises must be produced have been reserved. Moreover, government stores may buy such items from these businesses, such as wooden furniture, shoes, pickles, etc.

No Delayed Payment Disorders

The Government supports MSMEs against purchasers who do not pay on time. When delivering goods and services, where a date is specified in the agreement between MSMEs and customers, payment shall be made on or before the agreement. If no due date is specified, the purchaser must commence the payment within 15 days of accepting the goods and services. However, no bill shall extend 45 days after delivery of goods and services.

If the purchaser does not comply with these provisions, they must pay the penalty because of payment delays. The MSME registration means that the interests of small enterprises like you are not impacted.

Reduced Fees for Trademark Registration

The MSME registration card will also help you record your scores. It allows you to get a 50% allowance in the payment of fees while registering for a trademark or patent.

Foreign Business Expo

The Government funds micro, small and medium-sized businesses by offering financial assistance to engage in international expos. This way, you take care of your export and import interests. MSME benefits such as these encourage people to become entrepreneurs and

An exemption in interest on Overdraft

If your SSI is licensed under the MSMED Act, you will benefit from a 1 percent interest rate exemption on overdraft installs. The OD facility, however, differs from one financial institution to the other.

Facilities for Upgradation of Technology used in the industry

Compared to other sectors, SSIs have no financial resources. That may be a justification for using old equipment to produce products and services. Therefore, the government guarantees that the small enterprises receive funds under the Capital Assistance Program of Technical Upgrading to update their machinery. The MSME benefits are completely extensive. Isn’t it?

Subsidies and Government Schemes to promote your industry

The State Governments have implemented numerous schemes to encourage the company of SSIs. Such schemes such as the Pradhan Mantri Job Generation Plan and the Capacity Creation Plan are a perfect way to grow the businesses. The government also offers grants to help you increase your entire revenues.

Compensation for costs for ISO registration

Industries who have an MSME registration card are responsible for payments where and when ISO certification costs.

Electricity costs cut

You will obtain a big discount on your energy bills if your company is listed under the MSMED Act. You will thereby reduce the fixed costs incurred in the operation of your company. The MSME registration benefits give way to your industry ‘s proper production and growth.

You will also see how a certificate of MSME registration will help develop your business. With the streamlined Udyog Aadhar method, you can open the door to a host of benefits and become a prosperous businessman. You can thus make a valuable contribution to your economy’s growth.

MSME Eligibility Criteria for Service Entities

| Enterprises | Investment in Service Equipment’s |

| Micro Enterprise | Less than Rs 10 lakh |

| Small Enterprise | More than Rs 10 lakh but less than Rs 2 crore |

| Medium Enterprise | More than Rs 2 crore but less than Rs 5 crore |

[As you have to learn about the MSME Login Bonuses. What do you expect? What are you waiting for? Receive your MSME registration within 1 day, just click here to fill out the form]

Old investment-based MSME definition, MSMED Act, 2006

The Ministry of MSME is headquartered in New Delhi and is a division of the Indian Government that is the highest body to devise and administer the rules and laws of micro, small and medium-sized enterprises in the country.

With 11 crore jobs produced in India and 29 percent of GDP, we may conclude that MSMEs are essential to the Indian economy. And the shift in the concept would help Indian companies to properly operate their businesses.

Micro, Small and Medium Enterprises.

This act promotes the growth and creation and strengthens the productivity of micro-, small and medium-sized companies and related matters.

The company which produces goods or goods pertaining to any industry referred to in the Industry Law of 1951 (IDR Act, 1951) is: (a) a micro-business in which plant and equipment investment does not exceed Rs. 25 lakhs; (b) a small business with investments in the factory and mechanics more than Rs. 25 lakhs.

The undertaking engaged in the supply or rendering of services is said to be: (a) a micro-business with an equipment investment not exceeding Rs.10 lakhs; (b) a small business with equipment investments exceeding Rs. 10 lakhs but not above Rs.2 crore; (c) a medium-sized undertaking with an investment in equipment exceeding Rs.2 Crore but not above Rs.5 Crore.

“Section 15 deals with the obligation of the purchaser to make payment to Micro and Small Enterprise for goods supplied or services provided to the purchaser by the purchaser. According to this provision, payment shall be made within the time negotiated between the purchaser and the seller which shall in any case not exceed 45 days.

Again as per Sec. 16, if a purchaser refuses to make payment as per Sec. 15, he is liable to pay interest that will be measured at a monthly rate and multiplied at rates that will be three times the bank rate notified by RBI. However, as per Sec. 23, interest charged or payable as per Sec. 16 will be disallowed as a deduction when calculating income under the Income Tax Act , 1961.

“The investment in plant and machinery should be the original value, whether the plant and machinery is new or second-hand. The following should be included in the estimation of value with respect to the imported machinery.

(A) import duties (excluding various expenses such as transport from the port to the factory site, demurrage paid at the port);

(B) shipping costs; c. customs clearance costs and d. revenue or value-added tax The following shall be excluded during the measurement of the plant and equipment investment:

(i) equipment for repairs and the costs of consumable shops, such as machines, jigs, paint, molds and spare parts;

(ii) factory and equipment construction expenses;

(iii) facilities for research and development and facilities for emission control;

(iv) the power generation collection and additional transformer installed by the company according to the rules of the State Electricity Board;

(v) bank charges and service charges charged to the Small Industries National Corporation or to the Small Industries Government Corporation.

(v) procurement or installation of cables, wires, bus bars, electric panels (not mounted in individual machines), oil circuit breakers or miniature circuit breakers for electrical power supply to the plant and machinery or safety steps.

(vii) gas generation plants;

(viii) transport (excluding VAT or VAT and excise duty) charges for Indigenous machinery from the place of production to the company site.

(ix) charges charged for technological know-how in plant and equipment building.

(x) those storage tanks which only store and not associate raw materials and finished products with the manufacturing process, and (xi) equipment for fire fighting.

Unless the purchaser refuses to pay the balance to the seller in compliance with Section 15, the purchaser is liable to pay compound interest on the amount of monthly repository at three times the bank rate approved by the RBI.

‘Buyer’ means whoever buys any goods or receives any services from a supplier.

Sub-section (n) of section 2 of the Act, defines a supplier. As per the definition, a supplier means a micro or small enterprise, which has filed a memorandum with the District Industries Centre. Further, “supplier” also includes:

(i) the National Small Industries Corporation Ltd.;

(ii) a company under the Small Industries Development Corporation of a state or a Union territory.

(iii) any company, co-operative society, society, trust or body, engaged in selling goods produced by micro or small enterprises and rendering services which are provided by such enterprises.

“As per section 22 of the MSMED ACT, 2006, a buyer in its audited annual statements is required to furnish the following additional information :

(a) the principal amount and the interest due thereon (to be shown separately) remaining unpaid to any supplier as at the end of accounting year;

(b) the amount of interest paid by the buyer in terms of section 16 along with the amount of the payment made to the supplier beyond the appointed day during each accounting year;

(c) the amount of interest due and payable for the period of delay in making payment (which have been paid but beyond the appointed day during the year) but without adding the interest specified under the Act.

(d) The amount of interest accrued and remaining unpaid at the end of each accounting year; and

(e) The amount of further interest due and payable even in the succeeding years, until such date when the interest dues as above are actually paid to the small enterprise, for the purpose of disallowance as a deductible expenditure under section 23. “

UAM is a one-page registration form in a self- declaration format which can be filled online by a Micro, Small or Medium Enterprise (MSME). The MSME will be issued online, a unique identifier i.e. 12-digit Udyog Aadhaar Number which is called the Udyog Aadhaar Memorandum (UAM) Number. It replaces the earlier Entrepreneur Memorandum (EM-I / EM-II) which had a lengthy procedure.

UAM is applicable for Udyog Aadhaar (UA) is for running units only. There is no need to apply for upcoming units.

To get MSME registration certificate, business needs to get registered through concerned authority. We at Trendingindian.com can help you get MSME certificate in 1 working day.

No, business from either manufacturing sector or service sector can be registered under MSME Act

It is not compulsory to get your business registered under MSME act but it is suggested to get MSME registration certificate in order to avail various benefits.

Will you need help with MSME Registration? Please fill in the form below to contact

Also Read :

- Best Roti Maker in India 2020

- Top Ceiling Fan in India 2020

- Best Dough Maker in India 2020

- Best Spin Mop In India 2020

- Best water dispenser in India 2020

- Best Dry iron in India 2020

- Best Window Ac in India 2020

- Best Spilt Ac in india 2020